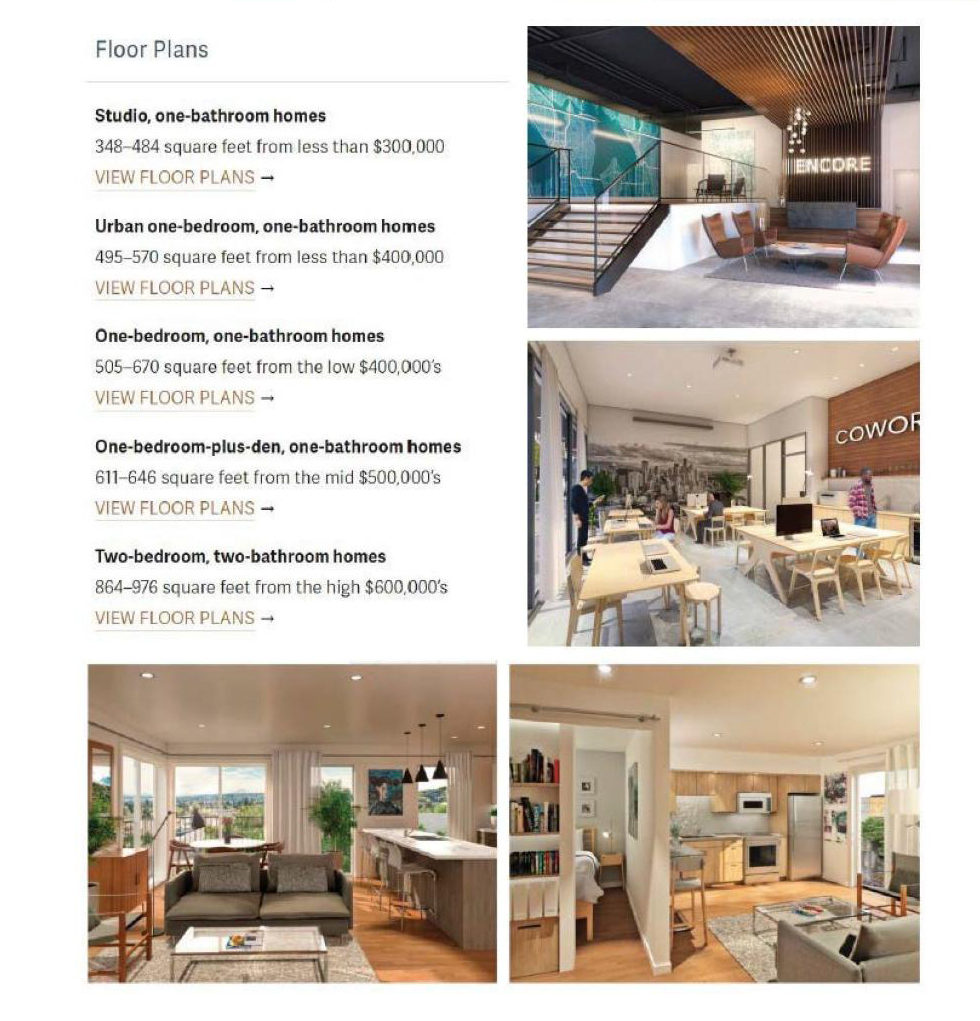

The 7-story condominium tower will contain 260 residential units and one level of underground parking, making it the largest residential project in the neighborhood – on a site of more than 30,000 square feet.

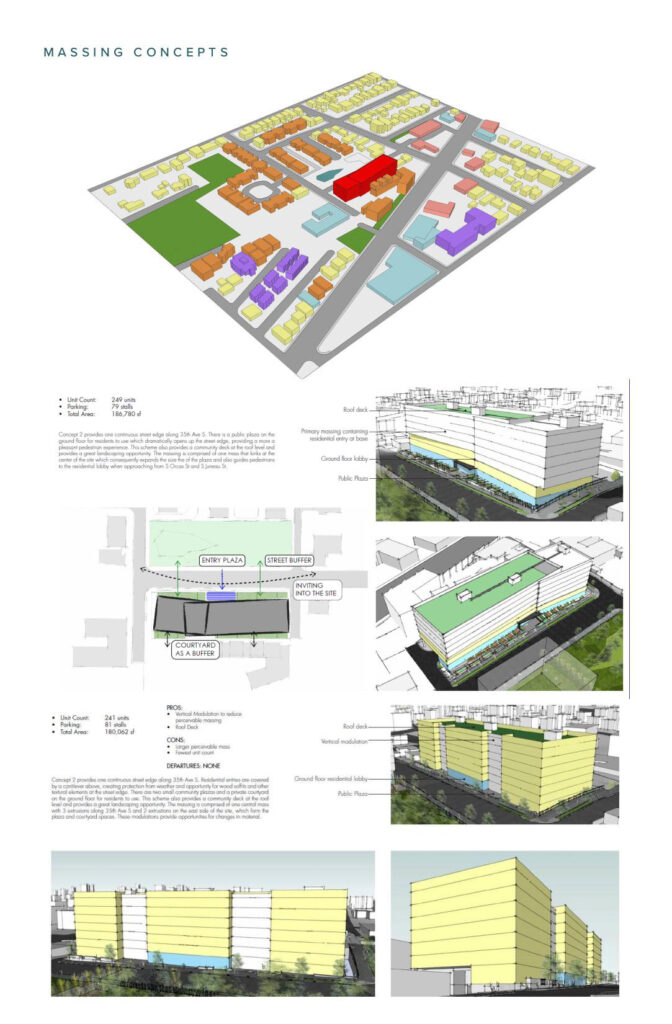

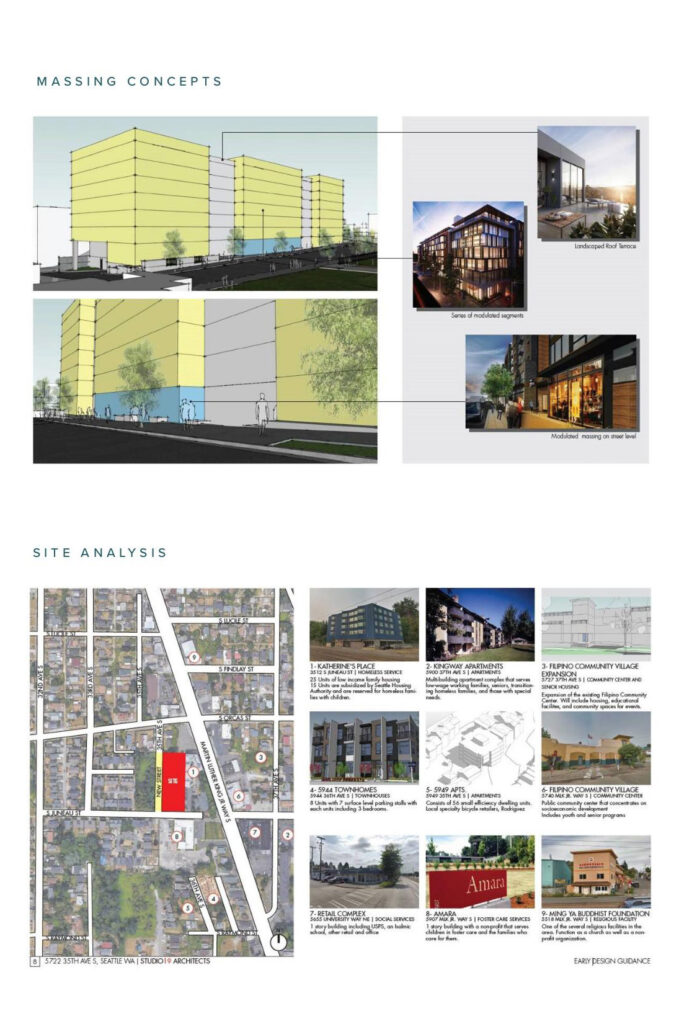

Project Renderings

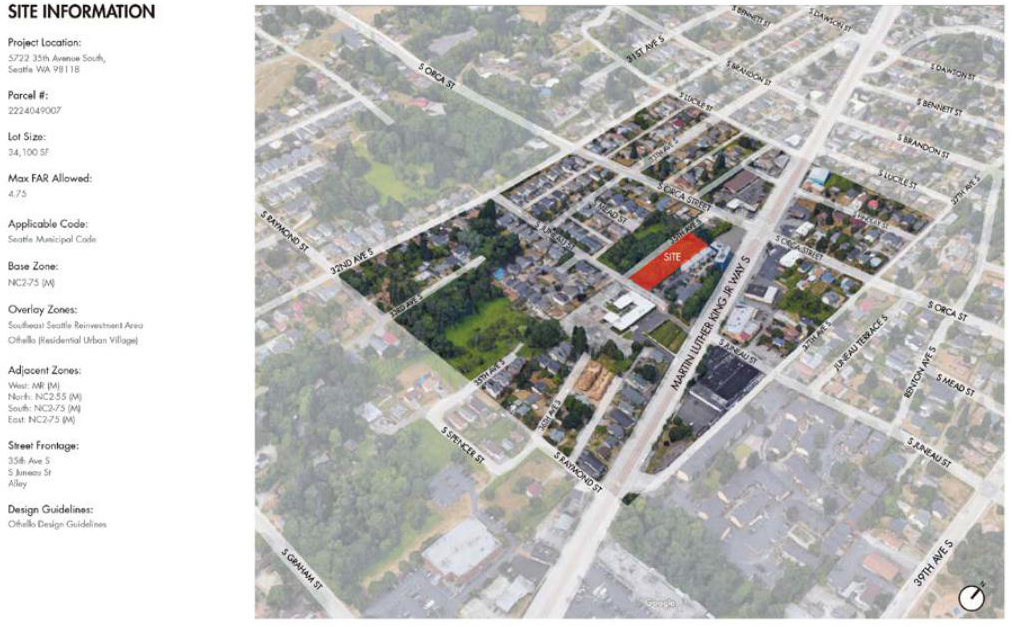

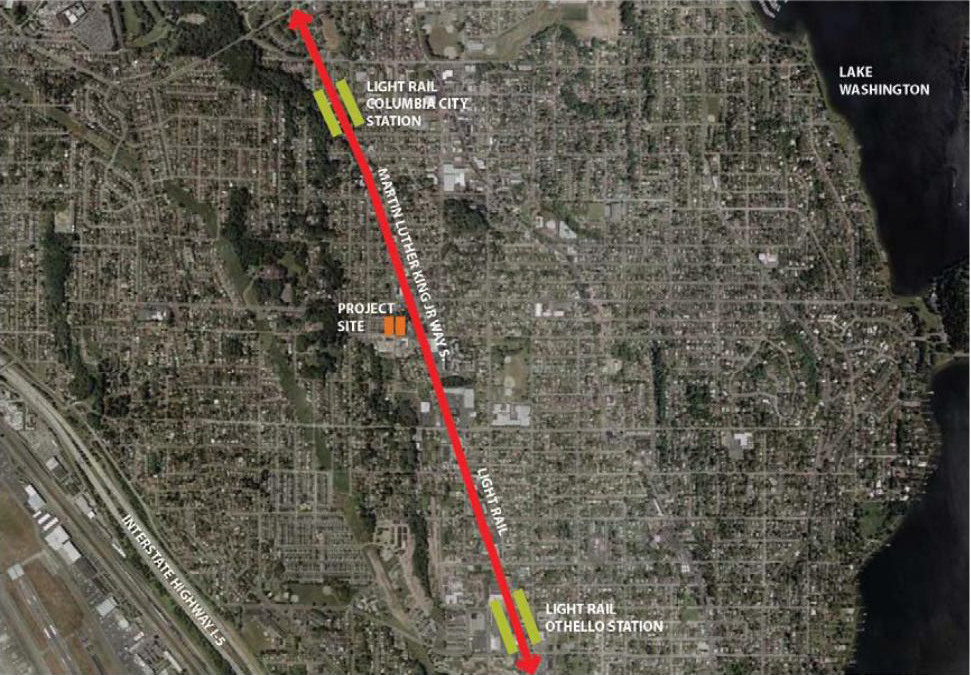

Project Location

Columbia, WA, where the project is located, has been repeatedly ranked as the best area to live in Washington State, and the community’s excellent public schools continue to attract young families and professionals to settle and become part of a diverse, creative, professional and liberal community atmosphere.

The site is within a 15-minute walk of the recently opened Columbia City Station (2009), which has brought in many new businesses and helped rebound housing values in the area. Development and growth continues to move south to Hillman City, which has been informally designated by many locals as Seattle’s next up-and-coming neighborhood.

| DEMOGRAPHICS | 1-MILE | 3-MILES | 5-MILES |

| 2019 Population | 47,214 | 101,257 | 198,754 |

| 2019 Average Household Size | 22,745 | 87,200 | 262,780 |

| 2019 Average Household Income | $158,329 | $179,098 | $171,308 |

| 2020 Renter Occupied Housing Units | $1,062,262 | $1,129,548 | $969,326 |

| College Degree | 73,478 | 169,181 | 368,504 |

| 2019 Employees | 5,309 | 64,321 | 64,321 |

Property Details

- SDCI Project Number: 3036025-LU

- Parcel Number: 2224049007

- Price: Undisclosed

- Lot Size: +/-34,100 SF

- MUP Approval: Pending

- Building Size: 7 stories

- Number of Units: 260 units

- Parking: One level of underground parking with 160 stalls

- 2018 Rezone: NC2-75

- Light Rail: A five minute walk to the anticipated South Graham’s Street Station, at the intersection of Martin Luther King Way Sand S Morgan Street, a new stop to the existing light-rail line expected to open in 2031.

General Overview of Seattle and the Current Real Estate Market

Seattle, as the leading economic center in Washington State, has been experiencing rapid growth in recent years and is one of the fastest growing emerging technology cities in the country. There are numerous Fortune 500 companies located in the area, including Amazon, Microsoft, Boeing, Costco, Expeida and other large companies that have set up their headquarters in the Seattle area, which has led to a steady increase in employment in the area since the beginning of the 13th year. At the same time, two major Air Force and Army military bases in Northwest America are located in Lakewood, a city south of Seattle, and the military adds more than 4,000 jobs to the region each year. Washington is also one of the largest export states for wine and various agricultural crops. Local warehousing and agricultural employment is also relatively well developed.

Seattle’s overall real estate market has been active since 2013, growing at an even rate of about 10% per year. This is a rare occurrence in the rest of the country. Most of the older, economically large states in the U.S., such as New York or California, generally conform to a 7-year cycle for real estate. And since Seattle is an emerging city, salaries have surpassed California to become the second highest in the nation in 2016, while real estate prices and the cost of living still have room to rise relative to California and New York. And with companies like Amazon and Microsoft adding 3,000-5,000 new jobs each year, the inventory of the commercial housing market fell to a mere 6 days of supply at the end of FY18. According to a Moody study, Seattle’s job market will add 17,000-23,000 new jobs per year between 2019-2024, which will continue to further increase the total population and demand for housing in the region. More than 13,000 new housing units are expected to be added to the demand each year.

Market Demand for Rental Apartments

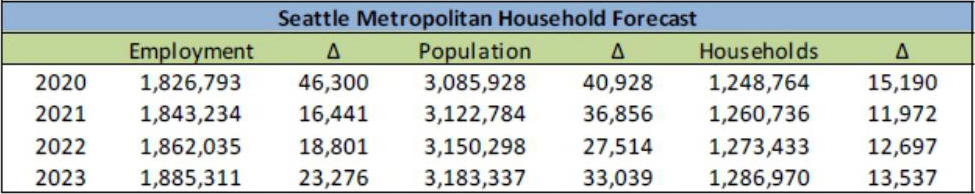

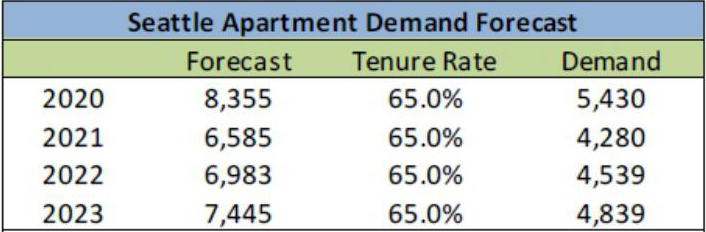

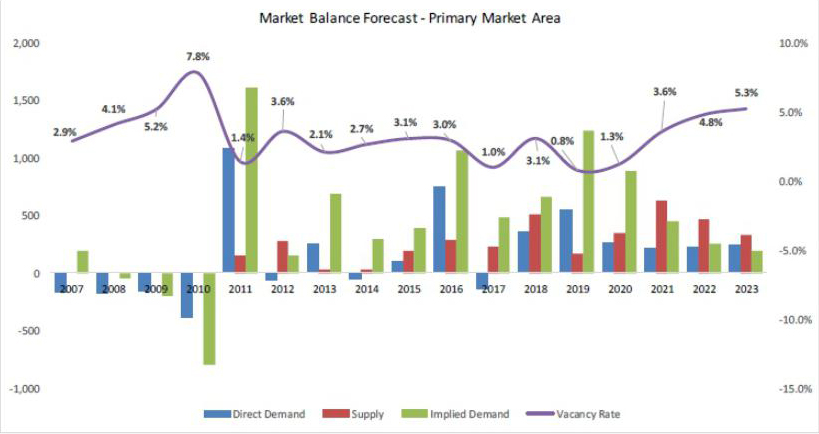

Seattle is expected to add 54,000 jobs between 2020-2023, and historical data shows that 35%-50% of the employed population in the area would traditionally choose a rental apartment as their housing preference, a figure that rose further after the subprime mortgage crisis in 2009. With the increase in the millennial population and the city’s character as a technology city. Most of the new employment is in the younger workforce and these young people are more inclined to urban quality living, which further benefits the demand for monolithic managed apartment buildings. Below are the demand forecasts for Seattle’s monolithic apartment buildings for 2020-2023.

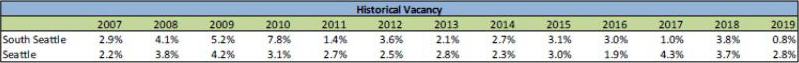

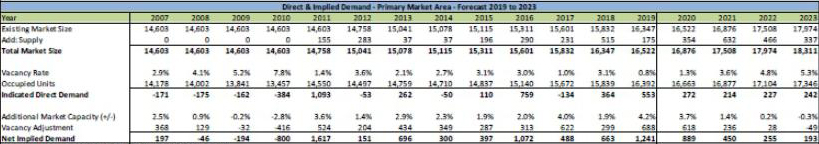

The current vacancy rate for rental apartment buildings in Seattle’s South End is very low, averaging around 3.2%, making it the lowest vacancy rate in all of Seattle. The main reason for this is that the South End is an older area with fewer new developments than the North End, so there is not a lot of existing inventory on the market. Once a new project is developed, it can basically be absorbed by the market. 2007-2019 data are as follows:

Impact of COVID 19 Outbreak on Real Estate Business in the Region

The outbreak of the COVID-19 epidemic in late 2019 hit the U.S. economy more severely, with job losses in many states, which in turn put mortgage payments and rental deliveries for some rental properties on hold. Hotel and office properties have been slow due to the government’s move to work from home. The Federal Reserve issued a $2.2 trillion bailout, of which nearly $600 billion was used to preserve home loans and rent payments and maintenance through SPVs that bypassed the banking system. The extent of the impact varied from state to state. Thankfully, because Seattle is located in Washington State, one of the least affected states in the nation, the second least affected state was Oregon. However, due to the school closures, student housing rental activity in the North End was down 8%, and the market was generally down 6% for the March 20Q. According to cold star’s 3Q20 market report, the South Zone was the least affected, with rental income down 4.8% and occupancy remaining at 94%. With the start of the Covid vaccine in March 2021 and the recovery of economic activity in all states, Coldstar’s Q1 2021 real estate market report shows that Seattle multifamily rental rents have begun to recover for the first time after 14 consecutive months of depression. For the record, all revenue estimates in this profile continue to use economic data from the worst downturn in 20 years to ensure the reliability of our budgets.

In the post-epidemic era, as the economy gradually recovered, the federal government continued its $1.9 trillion bailout program in early ’21, which provided a $15,000 direct home purchase tax credit for first home buyers through tax credits prompting a small spike in Seattle-area real estate in the first quarter of ’21. The total number of days to hold for all types of homes was only 4-6 days. As single-family properties sold quickly, developers were also accelerating construction to ensure that demand was met in the market. Lumber prices have also increased by nearly 40%. With this trend, we believe we will see a further spread of the downtown population to the periphery in the next 1-2 years, with more people coming to live and work in the area as Amazon, Microsoft, and Boeing companies resume construction. Demand for sales and rental properties will continue to outstrip supply. Rents and asset values are expected to continue to rise steadily. The key to the success of such projects is to control construction costs and reduce financial costs. Low interest financial instruments will be used to increase asset turnover and improve the return on investment.

Project Location

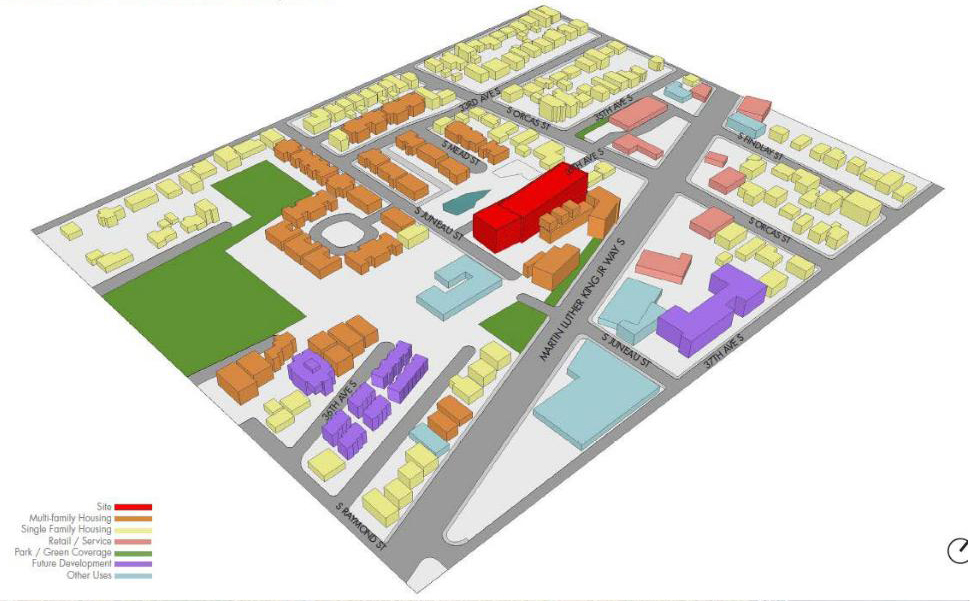

The Columbia District is a district of the City of Seattle, and is one of the key areas of development planned for Old South Seattle. Seattle has a total of 27 districts. It is divided into 3 blocks, North, South and West. The North District is centered on the University of Washington and the South District is centered on Chinatown, forming the Old Town development area. The West End is Seattle’s current downtown. From a development perspective. The majority of new developments in the North End and West End have been required to provide mandatory low-cost housing since March 2019, when the city moved the commercial development planning strategy for District 27, resulting in many North End and West End developments being uneconomic. The South Side is not affected by this policy as it is an old city development encouraged by the government. GI will provide data in the detailed due diligence report to verify the tax advantages of the project.

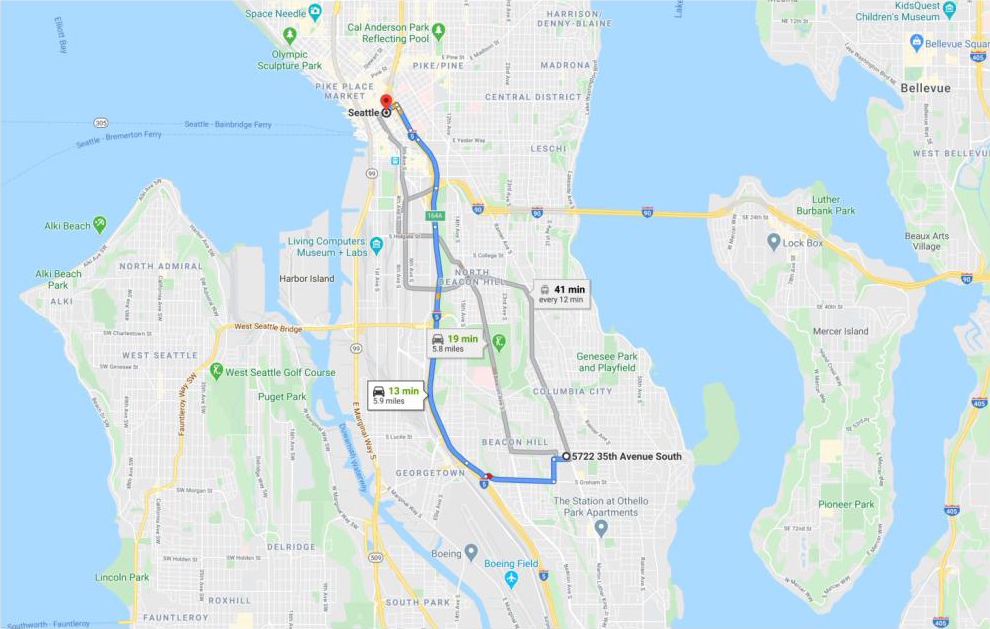

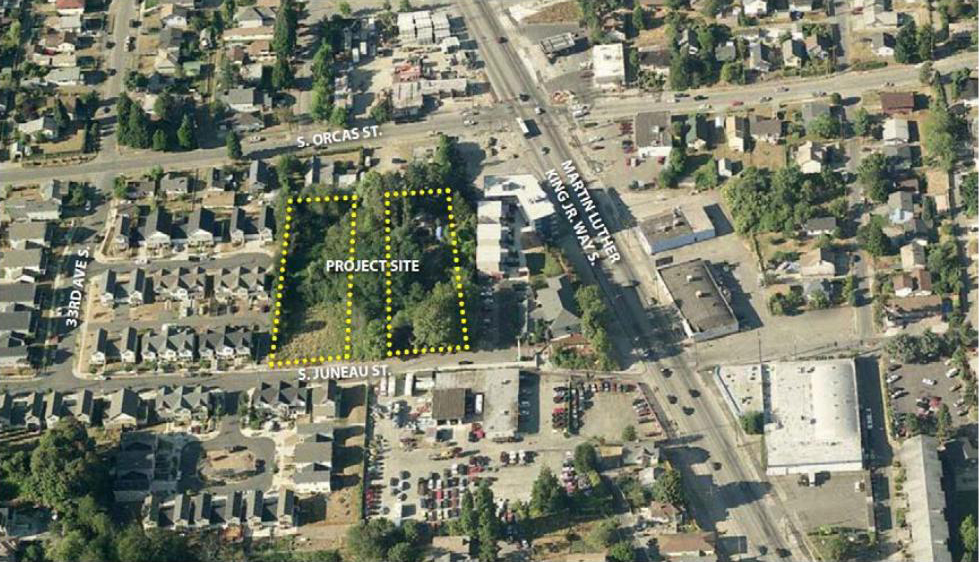

The Columbia City project is located on the southwest side of Rainier Canyon in Seattle, one block west of Martin Luther King Jr. The land is about 20 feet above street level. The neighborhood is well established, with largely residential apartments in the Katharine neighborhood, as well as residential neighborhoods such as NOJI Gardens and SONATA Columbia Station Apartments. It is also on the light rail line. There is a SODO station to the north and an Othello station to the south. It takes only 9 minutes to get to the center of Seattle by rail. Downtown Seattle is about 13 minutes away by car. It takes about 15 minutes to drive south to the airport. The orange locations are shown in the map below. The solid red line is the existing light rail line. The Grham light rail station is located just to the right of the existing Columbia City project site, a short walk of 200 meters.

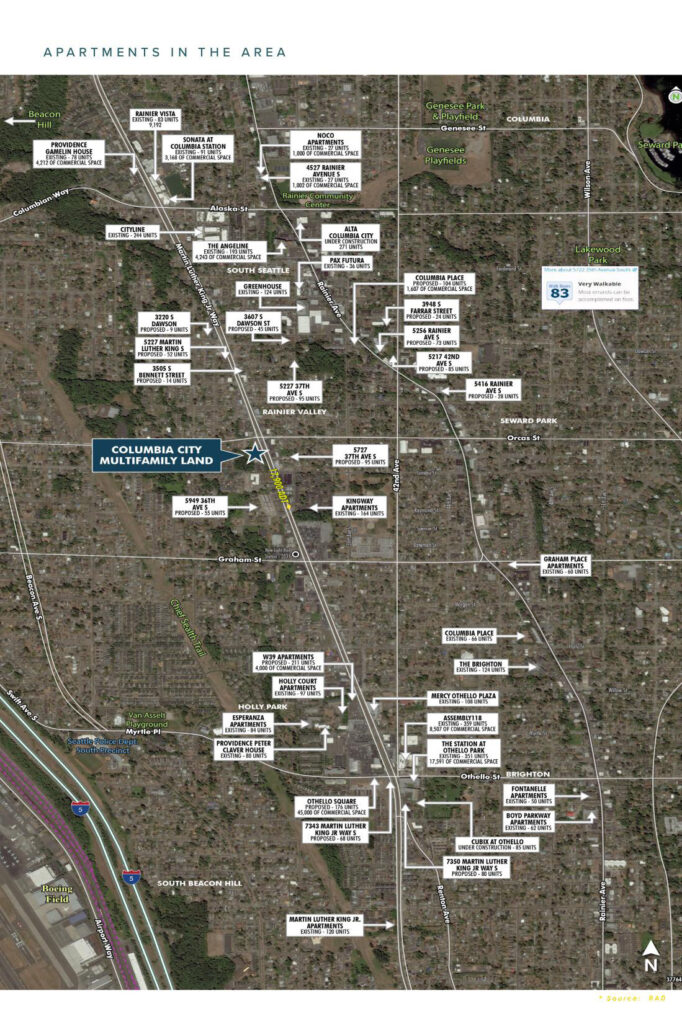

Apartment Buildings for Rent Around Columbia City

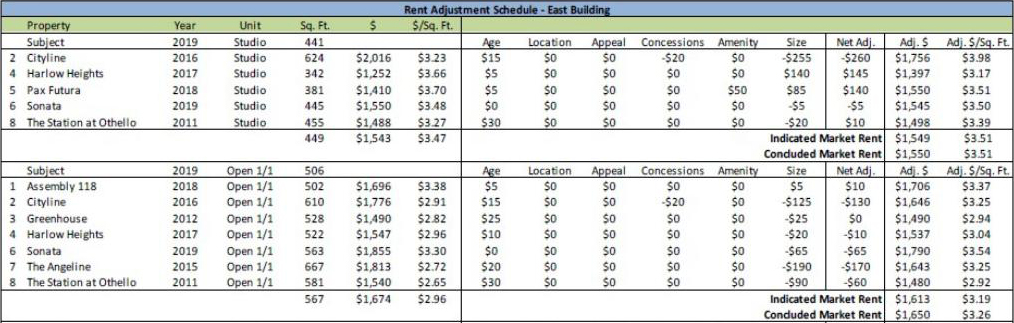

Numbers from our detailed research on the current rental situation of dozens of apartment complexes around Columbia City South shown that neighborhoods constructed within 10 years are largely renting steadily. Rents per square foot are averaging $3.16/sf per month (2021 data), and those completed after 2016 are basically averaging over $3.30/sf per month. Please see the official SONATA Apartments website for more details. This provides relatively promising market feedback for the development of apartment buildings in Columbia City.

Project Background

The Columbia City project land was placed on the market on May 14, 2018. The land was granted a building permit in 2008 (original 55′ height limit design plan, parcel size 65,000′ approximately 1.5 acres. Our bid for the land was successfully closed on August 1, 2018. The land is currently held in the name of the project company, Great Seattle Development LLC. We continue to invest an additional $2.5 million up and down for primary development. The entire project is currently in the primary development phase. The project is being developed by GI Group LLC, the developer of the project. Since acquiring the site in FY18, GI Group has conducted a tree inventory, soil environmental assessment due diligence, community hearings, and early planning meetings with the City of Seattle to determine the scale of development and roadway planning requirements, traffic requirements, wetland setback requirements, floor height restrictions, and floor area ratio requirements for the project.

Project Development Plan

The Columbia City condominium project will be developed in its entirety and the corresponding primary development process for the land has been substantially completed. The land was reorganized to change the C1 commercial use to NC275 mixed-use on the east side and the MR multi-story residential complex to MR-M on the west side. The two parcels of land were developed as one and integrated to reapply for building permits from the City. A building permit was issued for the site in 2008 for 190,000 square feet of development plus 54,000 square feet of common area. After GI took over the project, discussions were held with the city regarding the city’s current demand for commercial rental housing, and in accordance with the new 2018 land reform policy, the plot ratio was increased to 5.5, and the existing design plan NC2-75 allows for an increase in floor height to 75 feet, and the design plan has been approved by the architect and the city planning department. 350 units, 260 units in the East Building and 90 units in the West Building), and 70,000 square feet of parking (185 spaces). This is a 350-unit development. It is currently the largest condominium project in Seattle’s South End.

Project-Level Development Timeline

Since August 2018 to February 2020, we have done Phase 1 of new acreage mapping, tree inventory, community hearings, early bird development planning by the City, Re-zoning (adjusting the original height limit of 55 feet to the current plan of 75 feet) on both parcels greatly increasing the plot ratio and value of the land. Phase 2 has begun, with preliminary work on the east side building design, façade design, structural design, and road and water planning. The plan has been submitted to the city for review on January 29, 2020. The master plan for the west building has been completed, and the wetland landscaping has been measured and approved by the city. The current master plan for the West Building is 260 units (22,000 square meters) and the master plan for the West Building is 90 units (6,100 square meters).

From February 2020 to August 2020, we have been working with the City of Seattle Planning Department to make adjustments and changes to the East Building’s design plan, and we plan to have the final MUP plan approved for the East Building in September 2020. Phase 3 construction permit application and construction plan approval will begin in November 2020. Approval is expected in October 2021, and construction is scheduled to begin. The second phase of the fund will be used to raise funds for the start of construction. Of course, due to the impact of the New Crown epidemic, we hope to complete the land development and construction permitting phase of the project by October 2021. The government’s approval time has been extended slightly, but we are still in good communication and do not believe there will be any significant slowdown in progress.

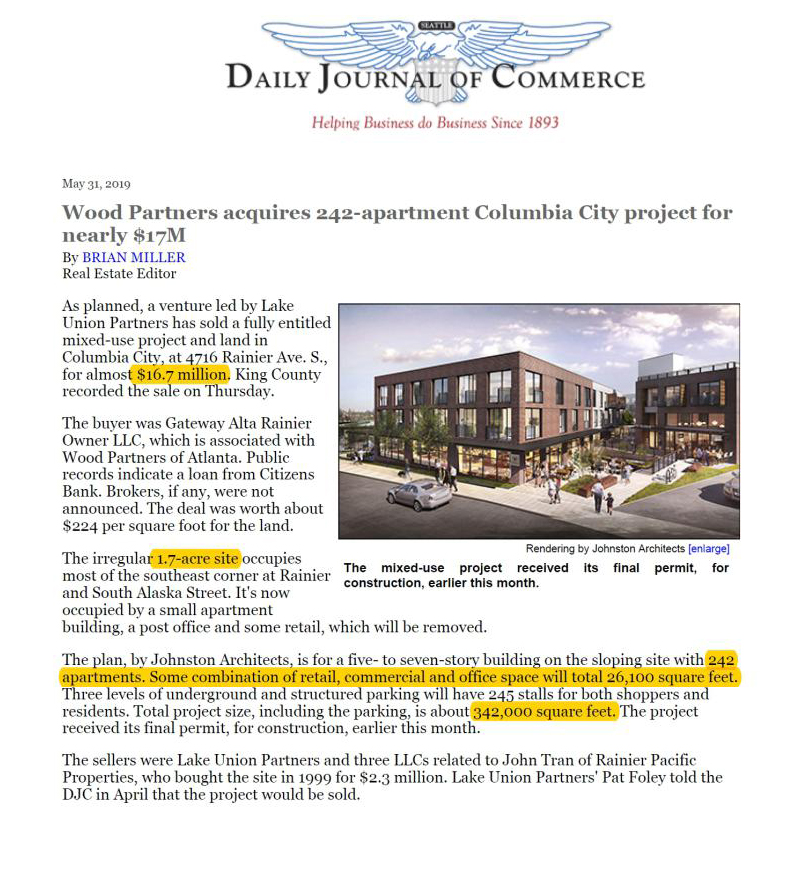

We have been coordinating with all departments and subcontractors throughout the development of the primary land. GI has maintained close communication with design institutes, wetland environmental assessment companies, civil engineering design and planning, structural engineering design and planning, landscape planning, traffic and road planning, tree environmental assessment companies, contractors, and relevant departments of the city and state governments to ensure that the primary development of the project is carried out properly. At the same time, GI has been working on the secondary development in response to the current market situation and has signed contracts with CBRE and several banks for the preparation of loans for the construction of the second phase of the project. GI has also made advance budget for the second phase of the project. GI has also been active in tax planning and has been advising clients on tax planning for other small projects in response to a series of IRS incentives for real estate development in 2018. We have made various recommendations to prepare for the tax savings of the Columbia City II project. Through the entire primary development, we have been able to increase the price per unit from $20,000 to $45,000 per unit of raw land value. The current market rate in the area is in the mid-$45,000s per unit with building permits. The highest sales prices are up to $69,000 per unit (wood partners’ land delivery on Rainier Street).

Land Sales in the Surrounding Area

Actuals for a similar 1.7 acre land sale on Rainier Street (0.7 miles from our project site), according to the Seattle Daily News May 31, 2019 report on new similar land sales in the area. The actual price of the land sale was $16.7 million for a 242 unit development. Our lot is 1.5 acres with a higher actual floor area ratio than that lot, a 350-unit development. The location is also closer to the downtown location than it is. It is expected that the land price will be more secure.

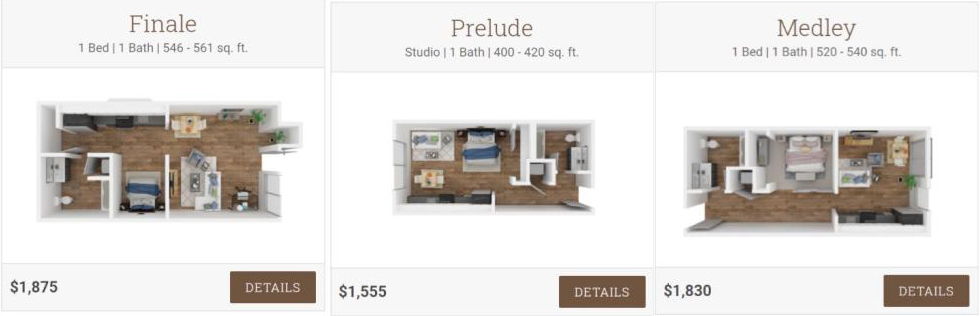

Leasing of Neighboring Apartment Building Projects and Sales of Commercial Properties

Most of the apartment buildings in the neighborhood are small to medium sized units ranging from 40-60 square meters, with a majority of small one bedrooms and large one bedrooms. The Columbia City project will follow the current market-accepted ratio, with the majority of the units being one-bedroom and large one-bedroom rental units ranging from 50 to 69 square meters. The top floor corners will be designed with an 8% larger two-bedroom option to increase the product mix in consideration of the views. The neighborhood is currently well rented at $3.10-$3.50 per square foot, with the smaller units positioned for more efficient rental income. Homes for sale in the area are currently selling for $650-$700 per square foot for similar projects. Our overall construction cost is only $300-$350 per square foot.

Project Phase II Timeline

The second phase of the project is expected to begin in November 2021, with construction of the 260-unit East Building to be completed in 24-26 months. Construction of the 90-unit west tower will begin in June 2022 and will take 18-22 months to complete. Leasing will begin at the same time as the end of 2023. Six months prior to completion, the property owner will begin promoting pre-rental advertising, and Seattle South’s current 2019 vacancy rate of 3.8% is relatively low. We have conducted due diligence on dozens of projects in the neighborhood and have obtained specific per-foot rental revenue data, as well as vacancy rate data. The area is currently projected to yield $3.16 per square foot of rental income.

Project Phase II Risks

- Construction cost control risk (Seattle real estate due to the hot, the cost can only be set in the form of a contract within 90 days before the start of construction, but the price of lumber is relatively high recently, the East Building construction costs will remain at $61.5 million);

- Interest rate risk (the Federal Reserve has been cutting interest rates recently, inevitably interest rates will increase in the future, adding financial costs to the construction loan, when the project is a HUD loan 40 years 3.675% APR, a very, very good loan);

- Rental risk, the new crown epidemic brought some impact on the rental segment, the market demand for rental housing fell by 4.6%, this factor has been taken into account in the financial model, with the economic recovery after the epidemic, I believe that there will be some relief;

- Force majeure risk (investment policy, tax policy changes brought about by the risk), the current Biden administration is positive and supportive attitude towards the real estate industry. The City of Seattle is also supportive of housing security, as the demand in the area does outstrip the supply, resulting in insufficient housing in the market.

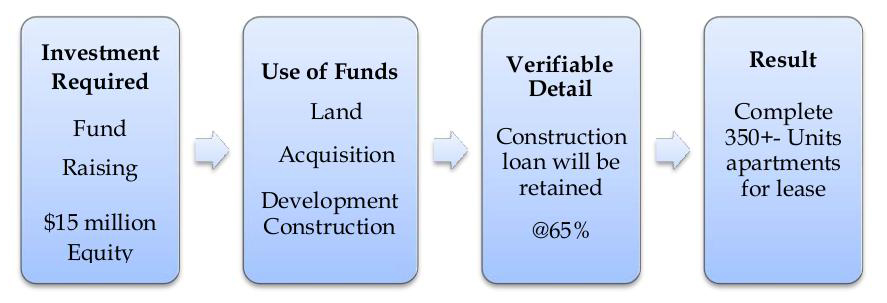

Structure and Details of the Phase II Development Fund

Columbia City Phase II is being developed and subsequently managed for lease and sale using fund management. The fund manager is GI Group LLC (GP), which raised the entire equity portion of the project in the form of a private equity fund from investment institutions and individuals (LP). The total equity portion of the East Building project is $15 million, and the remaining portion of the capital raise will be completed through a HUD construction loan, for which GI has currently secured a $64.5 million construction loan. GI as the fund manager can participate in 3%-5% of the equity contribution as co-investment. The remaining equity contribution is raised for investment institutions as well as individual investments. These funds will be used for land acquisitions, building construction, and the rest of the equity requirements in the construction loan application process.

Columbia City Phase II Building Fund (East Building Development Project)

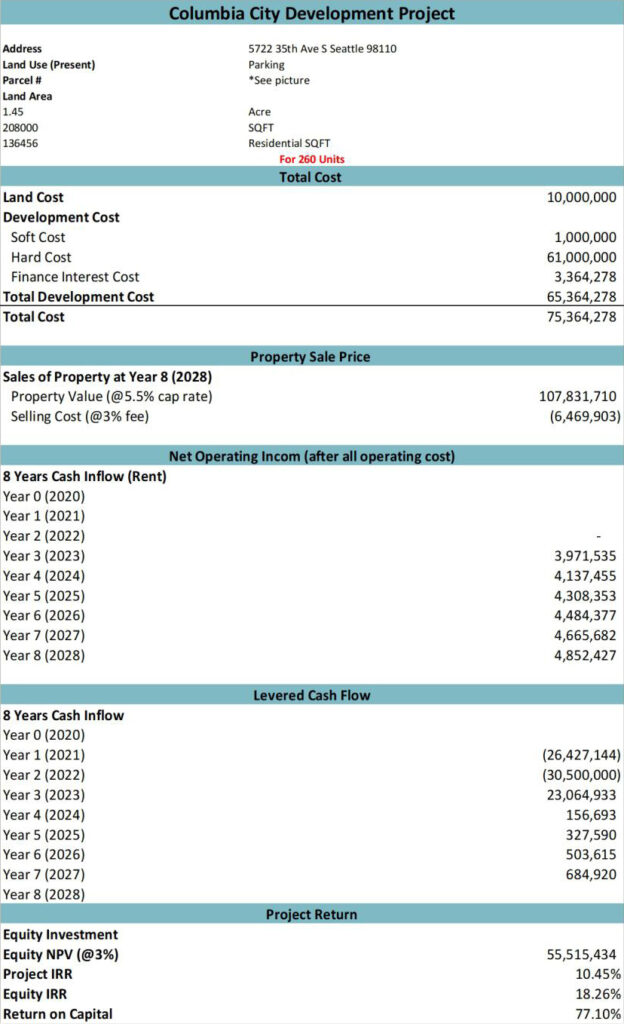

Total construction cost $275 per foot * 220,000 feet approximately $61.5 million Land cost: $10.5 million

Project development cost: $2.5 million

Project Hard Costs (Construction Costs):$61.5M

Finance cost (construction loan fees and interest for 3 years): $5 million

Total: $79.5 million

Equity portion of fundraising: $15 million

Construction loan: approximately $64.5 million

Fund life: 5 years (can be bought out in the 3rd year after the long-term debt is replaced with the construction loan if needed)

Expected Profit of the East Building Project Fund

Based on the current design plan size of 260 units and a fundraising standard of $15 million, the East Building project is expected to be held for 5 years at completion, with an annual NOI of $3.6-4 million, as estimated by CBRE, OConner Consulting and GI, respectively. The property is expected to have a present value of $104 million at 3% inflationary cash flow and a discounted value of $89.58 million at no inflationary cash flow after the property is held to maturity. The overall project equity portion of the gross profit reaches 77.1%, with an annual cash yield of 5.84%.

After the Project is Sold Out Profit Distribution Model By Waterfall

- First remove all expenses and fund management fees 2% per year

- Then return the principal to all investors

- Profits are based on 30% for management and 70% for investors

- After the project is completed, a 1031 Roller tax deferral is filed with all investors. The project will be transferred to the next project.

(1031Program is a tax deferral policy for the capital gains portion of a real estate project. As long as the capital gains portion continues to be invested in the next project, then no capital gains tax will be paid in the current period. (In addition to the 1031 program, GI will also set up an OZ fund in the Opportunity Zone tax-free project area for future investors to be exempt from capital gains tax)

We provide not only a real estate project development and operation agent, but also a full set of services for tax planning and asset allocation in the following years. We would like to work with your company to establish some cooperation in addition to project development. (Tax and financial planning cooperation)